In the ever-evolving world of investments, mutual funds and ETFs are two prominent choices that often puzzle investors. To make informed decisions, it's crucial to understand how these investment vehicles differ and what they offer. This exploration will guide you through their nuances, helping you grasp the intricacies of mutual funds and ETFs, and enabling you to align them with your financial goals.

The basic framework – Mutual funds vs ETFs

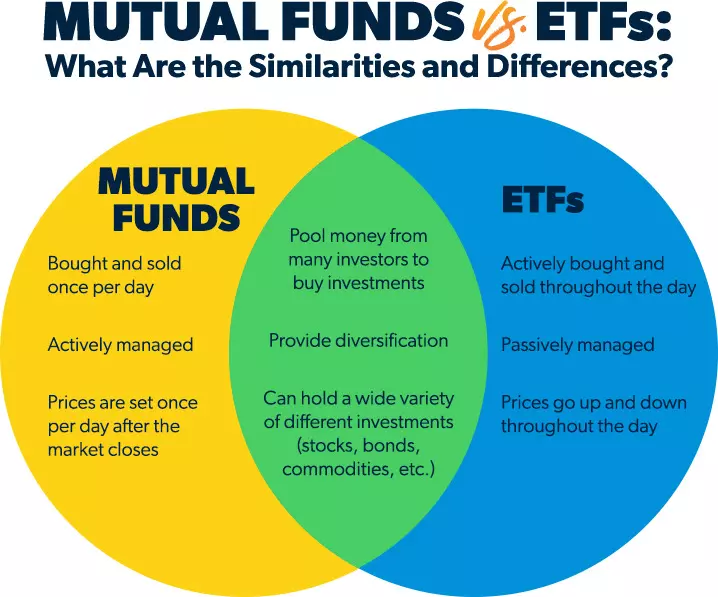

Mutual funds and ETFs, although similar in pooling money from investors, have distinct operational frameworks. A mutual fund is an investment vehicle where a fund manager actively manages the pool of money by buying and selling securities to meet the fund's investment objectives. On the other hand, an ETF—short for exchange-traded fund—tracks an index, commodity, or a basket of assets and trades on stock exchanges, much like individual stocks. This fundamental difference in their structure shapes how they function and perform in the market.

Cost considerations

When evaluating investments, costs play a pivotal role. Mutual funds generally have higher expense ratios due to active management and associated operational costs. These costs include management fees, administrative expenses, and sometimes sales charges or commissions. In contrast, ETFs typically have lower expense ratios as they are passively managed and often track indices. This cost efficiency makes ETFs an attractive option for cost-conscious investors looking to minimize fees while diversifying their portfolio.

Trading flexibility

One of the significant advantages of ETFs over mutual funds is their trading flexibility. ETFs are traded on stock exchanges throughout the trading day, allowing investors to buy or sell shares at market prices. This intraday trading feature provides liquidity and flexibility, enabling investors to react swiftly to market conditions. Conversely, mutual funds are priced at the end of the trading day, meaning investors can only buy or sell shares at the net asset value (NAV) calculated after the market closes, limiting flexibility in timing transactions.

Tax efficiency

Tax implications are a critical factor for investors to consider. ETFs are generally more tax-efficient than mutual funds due to their unique structure. ETFs use an in-kind creation and redemption process, which helps minimize taxable events within the fund. This process allows for the exchange of securities without triggering capital gains tax. In contrast, mutual funds may distribute capital gains to investors, leading to potential tax liabilities even if the investor did not sell any shares. This tax efficiency makes ETFs a preferred choice for investors seeking to optimize their after-tax returns.

Investment strategy

The investment strategies of mutual funds and ETFs can vary significantly. Mutual funds often have active management strategies, where fund managers make investment decisions based on research, analysis, and market predictions. These strategies aim to outperform the market and generate higher returns. On the other hand, ETFs typically follow passive investment strategies, aiming to replicate the performance of a specific index. This passive approach aligns with the goal of matching market returns, making ETFs suitable for investors seeking stable, long-term growth.

| Features | Mutual Funds | ETFs |

| Management | Actively managed by fund managers | Passively tracks an index |

| Trading | Priced at end of day NAV | Traded throughout the day on exchanges |

| Expense Ratios | Generally higher | Typically lower |

| Tax Efficiency | Potential capital gains distributions | More tax-efficient due to in-kind process |

| Investment Strategy | Active management | Passive indexing |

Accessibility and minimum investment

Accessibility and minimum investment requirements are essential considerations for retail investors. Mutual funds often have minimum investment thresholds, which can vary depending on the fund's objectives and policies. These minimums might pose a barrier for small investors looking to diversify their portfolios. Conversely, ETFs do not have minimum investment requirements, as they can be bought and sold like individual stocks. This feature makes ETFs more accessible to a broader range of investors, providing flexibility in portfolio construction and allocation.

Performance and risk evaluation

Evaluating the performance and risk associated with mutual funds and ETFs is crucial for informed investment decisions. Mutual funds, with their active management, have the potential to outperform the market but also carry the risk of underperformance due to manager decisions. The performance of mutual funds heavily depends on the skill and expertise of the fund manager. In contrast, ETFs aim to replicate the performance of an index, offering more predictable returns that align with market trends. However, the risk associated with ETFs is tied to market volatility, as they mirror the index they track.

Liquidity considerations

Liquidity is another key factor influencing investment choices. ETFs, being traded on stock exchanges, offer higher liquidity, allowing investors to enter or exit positions easily. This liquidity provides a level of security, ensuring that investors can readily convert their holdings to cash when needed. Mutual funds, while generally liquid, may have certain restrictions, such as redemption fees or lock-in periods, which can limit immediate access to funds. Understanding these liquidity aspects helps investors align their investment choices with their financial needs and goals.

Conclusion

Navigating the investment landscape requires a clear understanding of the options available. While both mutual funds and ETFs offer unique advantages, the choice ultimately depends on your preferences, financial goals, and risk tolerance. Whether opting for the active management of mutual funds or the cost-effective and tax-efficient nature of ETFs, both investment vehicles have the potential to contribute to a well-rounded investment portfolio.